When calculating the overall price of an item, shipping costs are often a crucial factor. These fees can differ greatly depending on variables like the dimension and address of the goods, as well as the transport type selected.

To minimize shipping costs, it's essential to understand the various contributing factors. This analysis will delve into the key components that shape shipping costs, providing practical guidance to help you control these expenses effectively.

- Understanding the Impact of Package Size and Weight

- Analyzing Shipping Method Options

- Address Considerations

- Calculating Estimated Shipping Costs

Transportation International Tax Implications

Navigating the complexities of international tax effects for logistics can be a daunting task for businesses. Taking into account the nature of your operations, you may encounter various tax systems in different jurisdictions. It's crucial to comprehend these rules to guarantee compliance and minimize your tax obligation.

- Considerations that can influence international tax consequences for logistics include:

- The state of departure

- Your destination

- The type of goods being transported

- Your mode of delivery

Considering expert advice from a tax specialist who specializes in international tax can be invaluable in navigating these complexities.

Expenses for Business Shipping

When managing a company, shipping expenses can add up quickly. Fortunately, the IRS recognizes you to write off a significant portion of these expenditures on your tax filing.

- Deductible shipping costs include charges for delivery services, packing materials, and protection.

- To enhance your tax savings, carefully track all shipping connected charges. Keep bills and other documentation to support your claims.

- Seek advice from a tax advisor to guarantee you are employing all available tax breaks. They can help you navigate the complex regulations surrounding shipping fees and enhance your tax position.

Determining Sales Tax on Shipping Costs

Calculating sales tax for shipping costs can sometimes be a bit confusing. First, you'll need to find out the applicable sales tax rate for your location. This rate varies depending on where both the seller and the customer reside. Once you have the tax rate, you'll simply compute it by the shipping cost to find the total sales tax amount. For example, if your state has a 6% sales tax rate and your shipping cost is $10, the sales tax would be 0.06 x $10 = $0.60.

Be sure to factor in this amount when you bill the customer. You can also choose to adjust the sales tax up or down to the nearest cent for easier computation. Remember, it's important to keep compliant with all local and state tax laws.

Shipping and Fees: What You Need to Know as an Ecommerce Seller

As an ecommerce seller, understanding the intricacies of shipping and tax is get more info crucial for success. Strategic shipping strategies can convert customers while minimizing costs.

Similarly,Regularly staying updated with tax regulations is vital to avoid penalties and maintain a strong business reputation.

- Compare various shipping carriers and their service offerings to find the best solution for your business needs.

- Estimate shipping costs accurately to minimize unexpected expenses and provide transparent pricing for customers.

- Set clear shipping policies that detail delivery times, handling fees, and any other relevant terms.

- Remain informed about federal, state, and local tax requirements for ecommerce businesses.

- Utilize tax software or services to simplify reporting.

By utilizing these best practices, you can effectively manage shipping and tax aspects of your ecommerce business, ultimately leading to a more sustainable operation.

Preventing Common Shipping and Tax Mistakes

Shipping and tax errors can be a headache for any businesses. To keep on top of your finances and provide a smooth client experience, it's essential to be acquainted with the common pitfalls. The key action is to accurately figure out shipping costs based on dimension and destination. Don't miss to factor in coverage for valuable items.

Additionally, it's crucial to comply with all relevant tax regulations. Stay up-to-date on modifications and consult with a tax professional if you have particular questions.

In conclusion, always give clear and precise information to your customers, like shipping expenses and potential taxes at checkout. This transparency can create trust and eliminate potential misunderstandings.

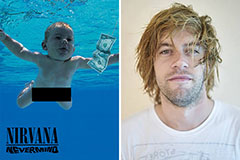

Spencer Elden Then & Now!

Spencer Elden Then & Now! Brandy Then & Now!

Brandy Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!